Building A Diversified Fund Portfolio: A Comprehensive Guide To Secure Your Financial Future

In today's ever-changing financial landscape, understanding the importance of a diversified fund portfolio has never been more crucial. By spreading your investments across various asset classes, sectors, and geographies, you can minimize risks while maximizing potential returns. A well-structured diversified fund portfolio acts as a safety net, protecting your wealth from market volatility and economic uncertainties.

Investing in a diversified fund portfolio is not just about putting your money in different places; it’s about creating a balanced approach that aligns with your financial goals and risk tolerance. Whether you're a beginner or an experienced investor, learning how to build a diversified fund portfolio is essential for long-term financial success.

Through this article, we will delve into the intricacies of diversified fund portfolios, providing you with actionable insights, expert advice, and practical strategies to help you construct a portfolio that suits your unique needs. Let’s explore the world of diversified investments and unlock the potential for a secure financial future.

Read also:Venture Capital The Key To Fueling Innovation And Entrepreneurial Growth

Table of Contents

- Introduction to Diversified Fund Portfolio

- Benefits of Diversified Fund Portfolio

- Types of Funds in a Diversified Portfolio

- Steps to Build a Diversified Fund Portfolio

- Managing Risk in a Diversified Portfolio

- Tools for Analyzing a Diversified Fund Portfolio

- Common Mistakes to Avoid

- Real-World Examples of Diversified Portfolios

- Tax Considerations for Diversified Fund Portfolio

- The Future of Diversified Fund Portfolio

- Conclusion

Introduction to Diversified Fund Portfolio

A diversified fund portfolio refers to the practice of investing in a wide range of financial instruments to reduce risk and enhance returns. This strategy involves spreading investments across different asset classes, such as stocks, bonds, real estate, commodities, and alternative investments. By doing so, investors can protect themselves from the adverse effects of market volatility and economic downturns.

Building a diversified fund portfolio is not just about owning multiple investments; it's about ensuring that these investments are not correlated. This means that when one asset class performs poorly, another may perform well, balancing out the overall portfolio performance. Understanding the concept of diversification is key to creating a robust financial plan.

Why Diversify Your Investments?

Diversification is a fundamental principle in investing. It helps mitigate risks associated with market fluctuations and ensures that your portfolio remains resilient in the face of economic uncertainties. By diversifying your investments, you can achieve a more stable and predictable return on investment.

- Reduces exposure to market risks

- Enhances potential for higher returns

- Provides flexibility in adapting to changing market conditions

Benefits of Diversified Fund Portfolio

Investing in a diversified fund portfolio offers numerous advantages that can significantly enhance your financial well-being. Below are some of the key benefits:

Risk Management

One of the primary benefits of a diversified fund portfolio is effective risk management. By spreading investments across various asset classes, sectors, and geographies, you can minimize the impact of any single investment's poor performance on your overall portfolio.

Long-Term Growth

Diversified fund portfolios are designed to provide consistent growth over the long term. By balancing high-risk and low-risk investments, you can achieve a steady return that aligns with your financial goals.

Read also:Discover The Mystical Power Of Jun 10 Zodiac Sign Your Ultimate Astrological Guide

Liquidity

A well-diversified portfolio ensures that you have access to liquid assets when needed. This flexibility allows you to meet unexpected expenses or take advantage of new investment opportunities without disrupting your overall financial plan.

Types of Funds in a Diversified Portfolio

A diversified fund portfolio typically includes a mix of different types of funds, each serving a specific purpose. Below are some of the most common types of funds you might consider:

Equity Funds

Equity funds invest primarily in stocks, offering the potential for high returns but also carrying higher risks. These funds are ideal for investors seeking growth opportunities.

Bond Funds

Bond funds focus on fixed-income investments, providing stability and regular income. They are a good choice for investors looking to preserve capital while earning consistent returns.

Real Estate Funds

Real estate funds allow investors to gain exposure to the real estate market without directly owning property. These funds can offer diversification benefits and potential for capital appreciation.

Steps to Build a Diversified Fund Portfolio

Constructing a diversified fund portfolio requires careful planning and execution. Follow these steps to build a portfolio that aligns with your financial goals:

Define Your Financial Goals

Start by identifying your short-term and long-term financial objectives. Determine how much risk you are willing to take and what kind of returns you expect from your investments.

Determine Asset Allocation

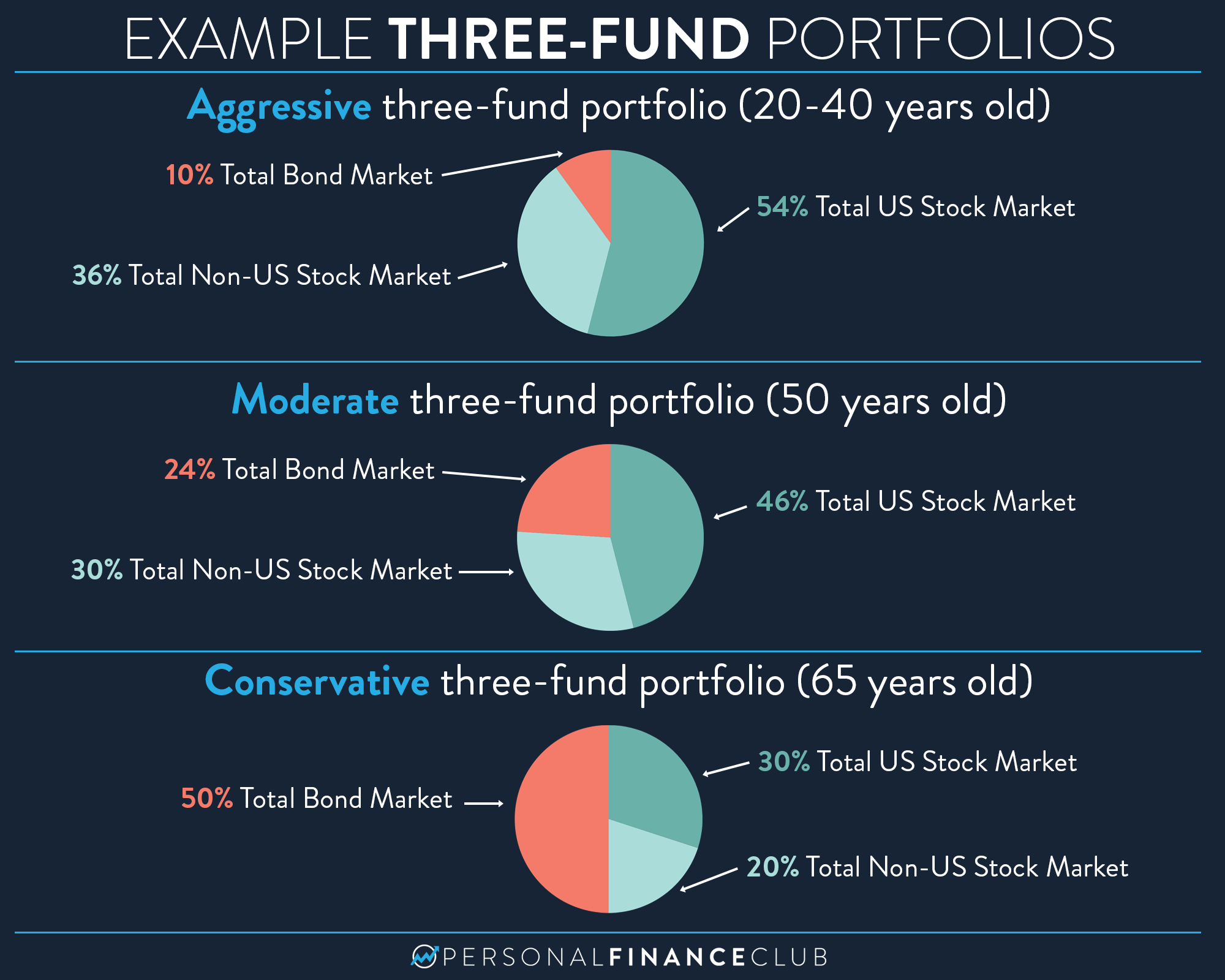

Decide on the proportion of each asset class in your portfolio. This will depend on your risk tolerance, investment horizon, and financial goals. A common rule of thumb is the "100 minus your age" rule, which suggests allocating a percentage of your portfolio to stocks equal to 100 minus your age.

Select Suitable Funds

Research and choose funds that fit your investment strategy. Consider factors such as fund performance, management expertise, and fees. It's important to select funds that complement each other and contribute to the overall diversification of your portfolio.

Managing Risk in a Diversified Portfolio

Risk management is a critical component of any diversified fund portfolio. Here are some strategies to effectively manage risks:

Rebalancing Your Portfolio

Periodically review and adjust your portfolio to ensure it remains aligned with your risk tolerance and financial goals. Rebalancing helps maintain the desired asset allocation and prevents any single investment from dominating your portfolio.

Using Hedging Strategies

Hedging involves using financial instruments, such as options or futures, to offset potential losses in your portfolio. This strategy can provide an additional layer of protection against market volatility.

Tools for Analyzing a Diversified Fund Portfolio

There are several tools and resources available to help you analyze and manage your diversified fund portfolio:

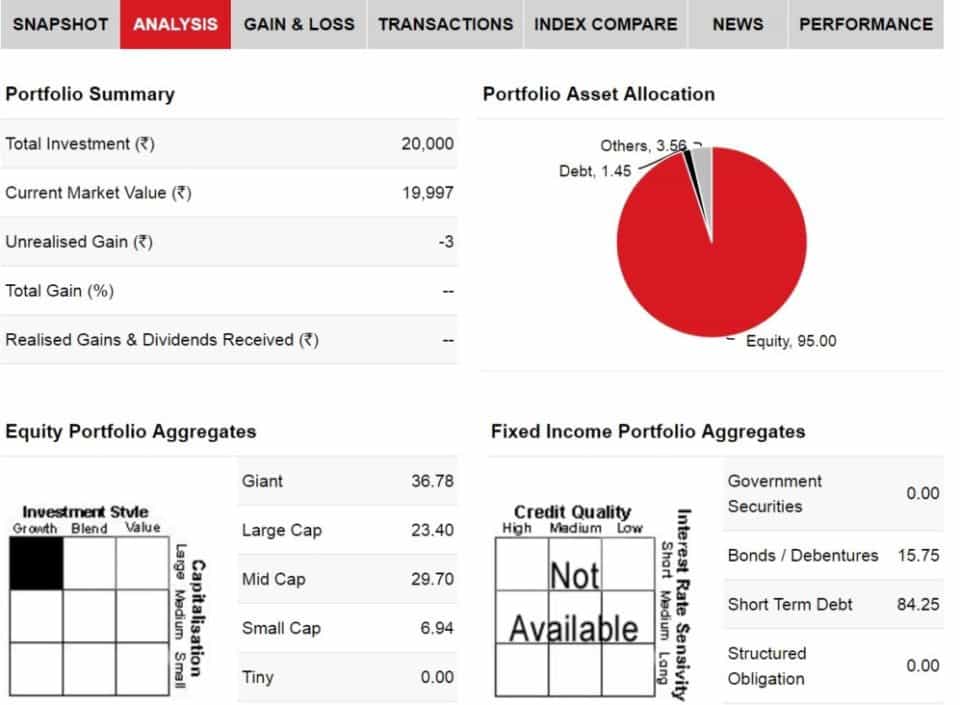

Portfolio Analyzers

Portfolio analyzers are software tools that assess the performance and risk profile of your investments. They provide detailed reports and recommendations to help you optimize your portfolio.

Consulting Financial Advisors

Working with a qualified financial advisor can provide valuable insights and guidance in building and managing a diversified fund portfolio. Advisors can help you navigate complex investment decisions and ensure your portfolio remains on track.

Common Mistakes to Avoid

When building a diversified fund portfolio, it's essential to be aware of common pitfalls that can undermine your investment strategy:

Over-Diversification

While diversification is important, over-diversification can dilute your returns and make it difficult to manage your portfolio effectively. Focus on quality investments rather than quantity.

Neglecting Rebalancing

Failing to regularly rebalance your portfolio can lead to an imbalance in asset allocation, increasing your exposure to unnecessary risks. Set a schedule for reviewing and adjusting your investments.

Real-World Examples of Diversified Portfolios

Examining real-world examples can provide valuable insights into how diversified fund portfolios work in practice:

Case Study 1: A Balanced Portfolio

A balanced portfolio typically consists of 60% stocks and 40% bonds, offering a mix of growth and stability. This allocation is suitable for investors with a moderate risk tolerance.

Case Study 2: Aggressive Growth Portfolio

An aggressive growth portfolio focuses on high-risk, high-reward investments, such as emerging market stocks and technology funds. This strategy is ideal for investors with a long-term horizon and high risk tolerance.

Tax Considerations for Diversified Fund Portfolio

Tax efficiency is an important aspect of managing a diversified fund portfolio. Consider the following strategies to optimize your tax situation:

Tax-Loss Harvesting

Tax-loss harvesting involves selling investments at a loss to offset gains in other parts of your portfolio. This strategy can reduce your taxable income and lower your overall tax burden.

Utilizing Retirement Accounts

Investing in tax-advantaged accounts, such as IRAs or 401(k)s, can provide significant tax benefits. These accounts allow your investments to grow tax-free or tax-deferred, enhancing your long-term returns.

The Future of Diversified Fund Portfolio

The financial landscape is constantly evolving, and so is the concept of diversified fund portfolios. Emerging trends such as ESG investing, artificial intelligence, and blockchain technology are reshaping the way we approach diversification. Staying informed and adaptable will be key to success in the future of investing.

Conclusion

Building a diversified fund portfolio is a strategic approach to investing that can help you achieve financial stability and growth. By understanding the benefits, types of funds, and steps involved in constructing a diversified portfolio, you can create a plan that aligns with your financial goals and risk tolerance.

We encourage you to take action by reviewing your current investments and considering how diversification can enhance your portfolio. Share your thoughts and experiences in the comments below, and don't forget to explore other articles on our site for more valuable insights into the world of finance.